‘Why your freelance Business needs an LLC?’. Well, that might look kinda wired and odd question. Yet, one of the few right questions you should ask yourself if you are already a freelancer.

I’m not an expert on forming business entities and the laws behind such processes. But, I know how to answer the burning question ‘Why your freelance Business needs an LLC and how to have one.’

If you think of taking your freelance business to the next level, then you should definitely be thinking of forming a Limited Liable Company (AKA LLC).

No matter where you are located, it really matters to have an organized business. And having a registered business entity will surely help you to gain and enjoy the exclusive benefits provided by banks.

This guide on why your freelance Business needs an LLC, in a way, will be beneficial if you are not a US resident.

I’m located in Sri Lanka, and the majority of my clients are from the US. And I started my freelancing career back in 2010, on Upwork (Formerly oDesk). When I’m gradually going forward with my freelance projects on Upwork, I decided to have my own freelance agency. This is where I really needed an LLC.

Table of Contents

What is an LLC?

You could find several definitions for this. Yet, this is what I understood.

A Limited liability Company or an LLC is simply a business structure. Either an Individual or several members can manage or own an LLC.

The most important thing about LLC is, owners are not responsible for any liabilities or debts that the company has. If someone sues your LLC, the law can only deal with your LLC no with your personal assets.

In a way, which is super handy if you run a business in the US and need to keep your personal assets safe from any business-related issues.

Again, I’m telling you, I’m not an expert in this particular matter. What I’m sharing is what I learned and the things I saw benefits for me and my Business.

Benefits of having an LLC as a freelancer

Well, if you check on the internet for this particular topic, you will find hundreds, if not thousands, of benefits of having an LLC.

Especially as a non-US resident with an LLC registered in the US. But here I’m going to tell you the benefits I got as a freelancer.

- I got an EIN

EIN stands for Employee Identification Number, which is pretty much similar to SSN (Social Security Number).

If you have ever tried to set up a PayPal, a Payoneer, or Transferwise account as a US freelancer, you probably have met the word SSN.

SSN is a 9 digit number issued to all permanent and temporary (People who work there) US residents.

If you are not a US resident or not working in the US, you may not get an SSN. But, if you form an LLC, then IRS (Internal Revenue Service) will issue your LLC an EIN.

With EIN, you can simply access almost all the facilities that are accessible to anyone with an SSN.

- I can have a US bank account, even if I’m not a US citizen

Yes, you heard it right. When you have formed an LLC (A legal business entity in the US), your Business will be treated as a registered business in the US.

This being said, you can apply for your US bank account.

Keep in mind, we talk about a real US bank account from an actual US bank. Not a virtual bank account.

When you are extensively working with clients from the US, having a US bank account is priceless.

But there’s a catch!

If you are a non-US resident and have an EIN, you should visit a US bank to open a US bank account.

After the 9/11 attack, this requirement has been enacted.

This is to physically verify the person who is opening the bank account. Even though almost all the leading banks process all the documents required to open a US bank account, they all need you to visit a branch personally to finalize the process.

If you visit the US for your business needs, then you can easily set up your bank account. All you need is an LLC.

Benefits of having a US bank account as a freelancer

- You can accept direct payments from your US clients.

I know for a fact the client love when we offer them such flexibility when they need to pay for our services. There’s no middle-man when your client pay. That means you will receive every penny the client has sent you.

- Zero fees (Or the Lowest fees)

Yes, when you offer your clients a means of paying you via ACH (Automated Clearing House), almost all the banks have ZERO fees for ACH payments. That will take the burden of paying extra processing fees.

No matter how big or how small the transaction is, the fees will be the lowest. It is one of the key factors that helped me to sustain my client retention.

- Higher Interests and Tax-free interests

If you are working with multiple cooperate clients, then it is sure that you shall have a steady and handsome monthly paycheck. When you receive money to your US bank account, that money is eligible to earn interest, and the interest is free from taxes.

- Unrestricted PayPal account

PayPal doesn’t operate in all the countries, and in Sri Lanka, the situation is the same. We can make payments via PayPal. But, still, we can not accept payments via PayPal.

PayPal is one of the widely discussed topics in Sri Lankan ‘online’ entrepreneurs. Still, Sri Lankan PayPal accounts are restricted to accept funds.

- Unrestricted Stripe account

If you are selling online, then credit card processing is one of the biggest hurdles you should pass to sustain your online business. Like PayPal, Stripe doesn’t operate in certain countries.

That includes Sri Lanka. If you are from such a country, where Stripe doesn’t provide their services, you need an LLC and a US bank account. Then it is super easy to have a fully operational Stripe account for all your payment processing needs.

I’ve never been to the US, then what?

With a US bank account and LLC, you can have a brand new PayPal account, which supports accepting funds. Having an unrestricted PayPal is having gold at your disposal when you are dealing with US clients.

I have an LLC, and I never visit the US. So, how come I’m going to have a US bank account?

Yup, I heard you and trust me, you got two of us!

With a Transferwise business account, you will be able to have a virtual US bank account. And that can be used to accept funds from your clients. I personally use my Transferwise business account to withdraw funds from Upwork.

Let me breakdown the numbers for you

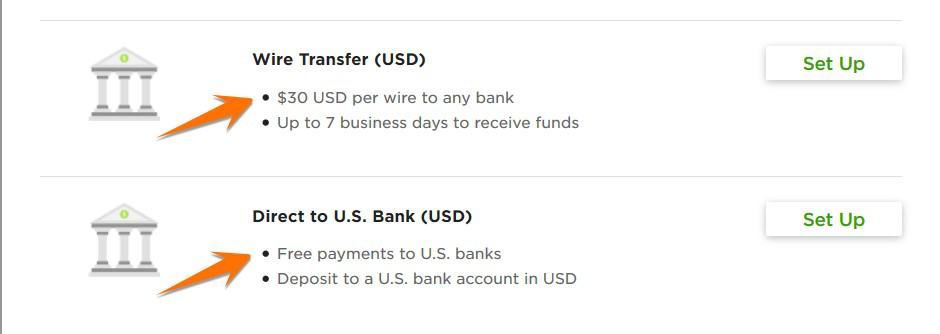

Before Transferwise, I withdrew the Upwork fund as ‘Wire Transfers,’ and single wire transaction cost me $30.

Yes, Upwork funds are stored in US bank accounts (Most probably). When I have a virtual US bank account that accepts ACH payments, it is entirely free to withdraw funds from Upwork.

See, my LLC is saving me $360 from Upwork alone, per year!

That’s Upwork alone and not to mention all the benefits and savings that can be unlocked with a US ‘virtual Bank account.’

How to form an LLC in the US

Okay, then, let me walk you through the process, which I did to form my LLC in the US.

Here’s what you should keep in mind before setting up your LLC.

I’m not selling any products on the US market nor have any real businesses there. That being said, the sole purpose of having an LLC in the US is to obtain my EIN and then have a US bank account.

But, if you have plans on opening a business in the US, then you should talk to your Registered agent first and should make sure all the legal prerequisites are in place before forming the LLC.

Things you need to register an LLC

As I understood, registering an LLC is super easy. Before registering an LLC, you should make sure to have followed in place.

- A Registered agent

The registered agent, in a way, a middle-man. When you form an LLC, the registered agent will be the one who is doing all the paperwork for you.

And the government will communicate with your registered agent, and the registered agent will communicate with the government on behalf of your business entity.

Depending on the state you form your LLC, you can find several registered agents.

From what I learned, there are 3 significant states where non-US residents prefer to form their LLC. Nevada, Delaware, and Wyoming are the top 3 I found. They have no state income taxes for the businesses operating outside these states.

That might be the reason most of the non-US residents love to form their LLCs in those states.

Forming an LLC will cost you money. It usually starts at $200. And to keep your LLC active, you should pay an annual fee. Again, this fee depends on the state you formed your LLC.

I formed my LLC in the state of Wyoming, and I’ve told me that the annual fee is just $99. (Including the registered agent’s fee)

- A US Address

When you are forming an LLC, you should make sure to establish a communication method. You need an address in the US. This address will be used to send you all the necessary documents to you.

Even though you are not living in the US, you still can have access to virtual mailboxes for less than $10/month.

These virtual mailbox providers will scan the envelopes of the mails you received and upload them to secured shared cloud storage, where you can see the scanned items.

If you need any particular enveloped to be opened, you can grant the mailbox provider to open it and send the scanned documents of the documents.

This way, you can make sure that you stay on top of all the legal documents, business-related documents being read by you. For less than $10 per month, it is a life-saver. Isn’t it?

- A US Phone number

This is not a must. But, I recommend that you have a US phone number in place. It is not essentially beneficial when forming your LLC.

But, it will come in handy once you have your EIN in place, and you are going to use your EIN to register an account in PayPal. This US number will be used to verify your ownership of your PayPal account (Also this will be used in Stripe verifications as well)

Textnow is the service I use. Which is free and can be used on both iOS and Android devices.

Forming a Wyoming LLC

Once all these are in place, you should reach out to your agent and seek their assistance in forming the LLC.

I registered my LLC in Wyoming, and my registered agent is Wyoming Trust & LLC Attorney. For the first year, they charged me $199 (All fees included), and when renewing the LLC, the total cost is $99.

They are fast and friendly. If you need any clarifications before forming your LLC, you better talk to Wyoming Trust & LLC Attorney for help.

They helped me on numerous occasions, and I shall have no hesitation in recommending them. I’ve not affiliated with them in any way.

Why your freelance Business needs an LLC: FAQs

Do you need a business to freelance?

Well, my advice to you is, if you are just starting your freelancing career and on a budget, don’t bother registering a business. Because it takes time and money. You can be easily discouraged when you are just starting your freelance journey and have to spend some money on forming a legal business. What I did, first I made some money. A stable stream of income and then moved to the expansion phase. So, I had some money to risk, and I knew what it takes to bring a business from the ground up! But, yes, if you need to take your freelance business to the next level, you need a business. More specifically, you are going to need an LLC when you need your freelance business. That’s why I wrote this detailed guide on Why your freelance Business needs an LLC.

Should I get an LLC or sole proprietorship?

If you are a US citizen, yes, you can quickly sign up for a sole proprietorship. As you already have an SSN, then you can have a business registered for your name. But, this guide on Why your freelance Business needs an LLC was prepared for people who aren’t US citizens and need an LLC in the US to expand their freelance business. I recommend that you should get an LLC whether or not you are a US citizen. Because LLCs are independent entities, and your personal assets can not be and will not be bound to your LLC in a case of law suite. If your LLC gets sued for any reason, your personal assets will be safe from any form of takeovers. As far as I know, the risk is almost zero, and I highly recommend an LLC over Sole Proprietorship.

Do I need an LLC for freelance?

No, you don’t need an LLC for freelance. If you have skills and time, you are almost ready to start working as a freelancer. You are going to need an LLC, whenever you think you should take your freelancing business to the next level. Being a freelancer is not easy. Let’s say that you are finding clients from Upwork and Upwork alone. For any unknown reasons, your Upwork account gets banned. Then what? Is that the end of your freelance journey? Well, it might be of you have put all your eggs into one basket! This is why you need an exit strategy, and That is why I recommend you to have your own business (an LLC).

Is LLC best for small businesses?

It depends. As far as I know, if you are an individual freelancer who is looking to expand your freelance business, then an LLC will be enough. But, if you are working with a team of multi-talented freelancers and having broader business ideas, then you should talk to someone who knows all these business laws before jump into conclusions.

Conclusion: Why your freelance Business needs an LLC

In the article, I shared things I learned when I’m trying to form my LLC in the US. Again, I’m reminding you that I’m not an expert on business law.

And if you are looking for answers to ‘Why your freelance business needs an LLC’, then I sincerely hope my experiences will add something in value for your efforts. Here’s the thing you should keep in mind when you are thinking of having an LLC for your freelance business. LLC is not a must if you are a freelancer.

In my opinion, you should not be thinking of an LLC if you are just starting your freelancing journey. Having an LLC would be beneficial when you are a freelancer who mostly deals with clients from the US and is not a US citizen in the first place.

With LLC, you will be able to obtain an EIN from IRS, and with EIN, you will be able to open doors to your business. The same doors which are already opened to a US resident.

Forming and maintaining an LLC is not free. It requires money. Well, nothing comes for free, and you will have to spare some money for good things. Ultimately you will be able to cover up all your expenses on your LLC by leveraging LLC in the right way.

![The best way to get your Upwork profile approved [I have billed 10,000 hours on Upwork] 9 get your Upwork profile approved](https://iwannabeafreelancer.com/storage-files/2020/07/get-your-Upwork-profile-approved-120x86.jpg)

![How to send personalized mass emails in Gmail [Guide] 21 How to send personalized mass emails in Gmail](https://iwannabeafreelancer.com/storage-files/2020/06/woman-using-computer-at-work-RKH2LLD-75x75.jpg)